- Quotes from commercial property insurance specialists

- Cover options for buildings, contents and landlord risks

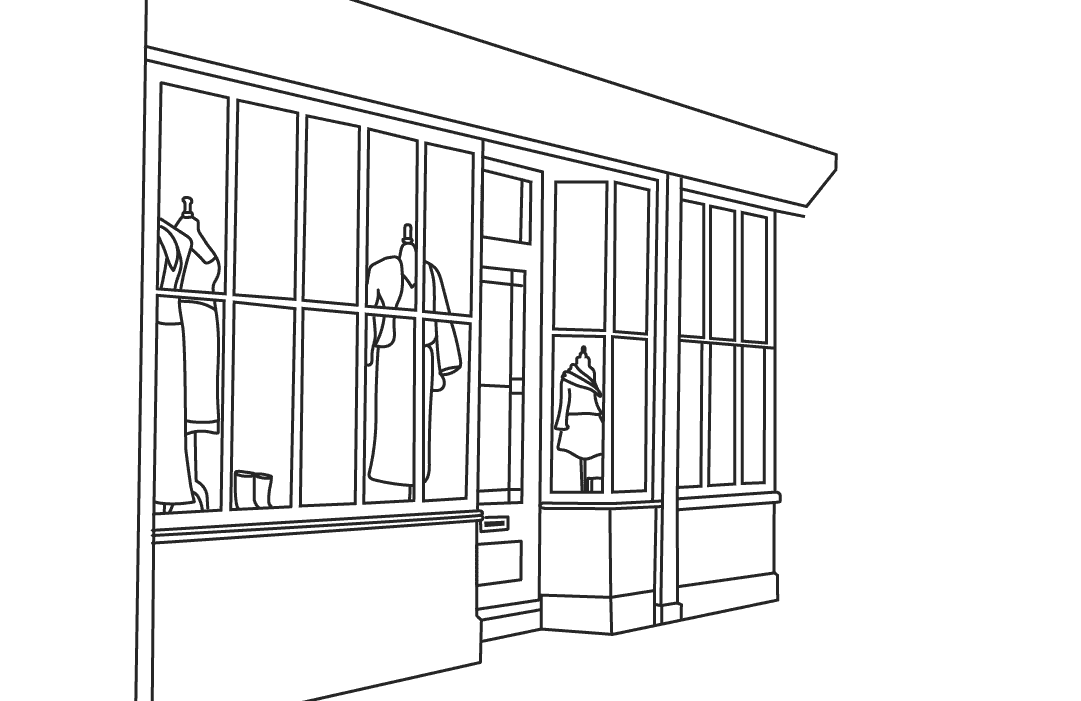

- Options available for shops, offices and business premises

- Compare commercial property insurance with one quick form

We partner with specialist insurance providers including

Why QuoteSearcher for Commercial Property Insurance?

Owning or managing a commercial property comes with a unique set of risks. Whether the building is for your own business or rented out to tenants, many property owners look for insurance that covers both the structure and its contents. Damage can come from fire, flooding, or accidents, and it’s not just the building itself. Fixtures, fittings, stock, and business equipment can all be affected, and tenants may unintentionally create additional liabilities.

Beyond physical damage, commercial property insurance may include cover for certain financial losses, depending on the policy. Employee injury, legal costs, and business interruptions are all factors to consider. Complete a short form with QuoteSearcher, and our panel of specialist brokers will get in touch to outline your cover options.

Customer's Love Our Service

Quick quote, no hassle and saved £700!

Fantastic can't fault in any way, would use time and again and recommend to all!

Excellent and fast service, will use again.

Quick helpful and cheap, can’t complain at anything. Thanks very much.

Found the site easy to use, had good feedback from four companies, all very competitive.

Helpful and efficient service, I was impressed how quickly I received my quotes.

Very quick responses and completed selection and purchase of a very competitive new policy within 24 hours.

Very good and easy to use, this has not only saved me money but also saved me a lot of phone calls and time, thank you.

Excellent service and delivered quicker than the website said. Have bought and will buy much more from here. Prices very competitive and often much cheaper. Yet to find something I want that they don't have.

Thought they were very good there was no need to ring around and I found what I was looking for.

Commercial Property Insurance Policy Features

Depending on the insurer and the structure of your policy, commercial property insurance may include the following features:

Building and Contents cover

May cover damage to the property itself, furniture, fixtures, and equipment from incidents such as fire, flooding, or vandalism. Find out more here.

Liability Cover

Includes both public and employee liability to protect against legal costs and compensation claims. Learn more about Public and Employee Liability Cover.

Tenant-Related Cover

Depending on the policy, it could protect against theft, damage, or loss of rental income caused by tenants. Find out more about Tenant-Related Cover.

Business Cover

Cover options that may address a range of risks linked to your building and business operations. You can read more about it here.

Commercial Combined Cover

Some policies combine multiple covers into one arrangement, which may include:

- Stock and business equipment

- Building and fixtures

- Business interruption

- Goods in transit

- Liability cover

- Loss of rental income

- On-site money

- Theft by employees

Buildings Insurance

Commercial buildings, especially those rented to tenants, may be assessed as higher risk by insurers. A small leak left unattended, for example, could turn into a major repair job. Buildings insurance may provide cover towards repair or rebuilding costs after an accident.

Exclusions usually apply to general wear and tear, carpets, and damage from acts of war or terrorism, which require specialist policies.

Liability Cover

Public Liability may protect you if a third party is injured on your property, covering legal costs and compensation.

Employee Liability is required by law for any business with employees, whether paid or volunteer, and covers claims arising from workplace injury or illness.

Contents Insurance

If your property is rented to tenants, they are usually responsible for insuring the contents. However, landlords may choose to arrange Commercial Premises Insurance and pass the cost on.

When valuing stock and business equipment, insurers typically consider:

- Cost price, not sale price, is what insurers consider.

- Seasonal stock increases, like Christmas, may need to be taken into account when arranging cover.

Decide on the type of cover for your equipment:

- Replacement as new – items are replaced with new ones if lost or damaged.

Indemnity policy – pays out based on the current value, accounting for depreciation.

Managing Commercial Properties

Commercial properties are exposed to more foot traffic and varied use than residential buildings. This increases the risks of wear and tear, accidents, and liability claims. Public liability insurance is commonly considered by commercial property owners. Some may also choose to explore cover options for legal fees, loss of rent, or business interruption, depending on their circumstances.